Understanding Medicare Coverage

Understanding Medicare can be, without a doubt, a daunting task, especially when you're trying to determine what kinds of surgery and treatments are covered. Medicare is a federal health insurance program that generally caters to individuals who are 65 and older. But it also helps younger people with disabilities and certain diseases.The Components of Medicare: Parts and Pieces

Medicare consists of several parts, each focusing on different aspects of health care. Understanding these parts is crucial when evaluating coverage for surgeries or treatments:- Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. It's typically premium-free for those who have paid Medicare taxes for a certain period.

- Part B (Medical Insurance): Covers certain doctors' services, outpatient care, medical supplies, and preventive services. This part might come with premiums.

- Part C (Medicare Advantage Plans): These plans are an all-in-one option covered by private companies that contract with Medicare. They include Parts A and B and sometimes offer extra benefits such as vision care.

- Part D (Prescription Drug Coverage): Adds prescription drug coverage to the Original Medicare and some Medicare Cost Plans, Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans.

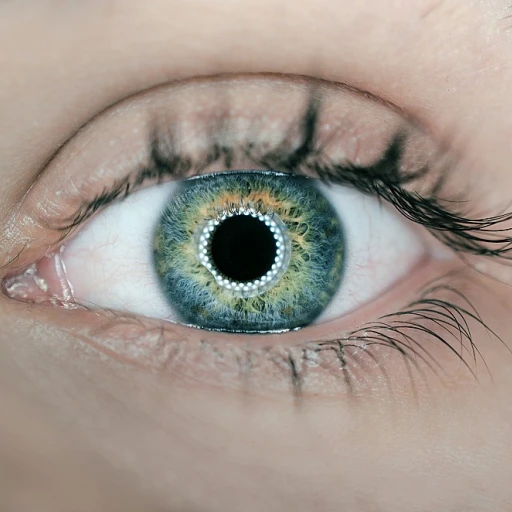

Identifying Coverage for Eye-Related Surgeries

When it comes to eye surgeries, one might wonder, "does Medicare cover procedures like Lasik or cataract surgery?" Generally, traditional Medicare – Parts A and B – does not cover routine vision care services, including eye exams for prescription glasses or contact lenses. However, Medicare does offer coverage for cataract surgery. Under specific conditions, it may cover certain preventive and diagnostic eye exams too. For those considering laser surgeries like LASIK, it's generally not covered, as it’s considered an elective procedure. On the other hand, cataract surgery is considered a necessary treatment and is covered under certain criteria.Weighing Your Options

It’s essential to review all parts of Medicare to understand what eye surgery coverage entails. Original Medicare alone might not cover specific surgeries, but Medicare Advantage plans can offer additional benefits and advantages, sometimes covering eye care that Original Medicare does not. To get a deeper understanding of Medicare's coverage, especially when it involves surgeries that sit outside traditional routes, you might want to explore topics like high-limit accident insurance for extra financial security Understanding the intricacies of Medicare's components. This could provide insights into how individuals can navigate additional benefits that may align with personal healthcare needs.Laser Eye Surgery: What It Entails

Exploring the Process and Advantages of Laser Eye Procedures

Laser eye surgery has become a popular solution for individuals seeking to improve their vision and reduce dependency on corrective lenses, including glasses and contact lenses. The most well-known types of laser eye procedures are LASIK and cataract surgery, both of which offer significant benefits, though they cater to different eye needs.

LASIK Surgery

LASIK (Laser-Assisted In-Situ Keratomileusis) is designed primarily for those who struggle with common refractive errors such as nearsightedness, farsightedness, or astigmatism. This procedure works by reshaping the cornea using a laser, allowing light entering the eye to be properly focused onto the retina, thus improving clarity and overall vision. LASIK typically offers a quick recovery time and a high success rate; however, patients should be aware that this type of eye surgery may not be suitable for everyone, especially those with specific eye health concerns.

Cataract Surgery

Cataract surgery, on the other hand, is intended for individuals with cataracts—a condition characterized by clouded eye lenses which can lead to vision impairment. This surgery involves removing the clouded lens of the eye and replacing it with an artificial one, restoring transparency and improving sight. It is considered a safe procedure with a high success rate, often covered by certain Medicare plans under specific conditions.

For those exploring their insurance options, understanding the nuances of these procedures, including the type of surgery that best fits their needs, is essential. While Medicare and other insurance plans may cover some procedures and associated costs, coverage can depend greatly on factors like the type of procedure, the patient’s medical necessity, and whether the surgery aligns with Medicare’s definitions. Exploring these variations can aid individuals in making informed decisions about their vision care needs.

Medicare's Stance on Laser Eye Surgery

The Complexities of Medicare Coverage for Laser Eye Surgery

Navigating the intricate web of Medicare's coverage for eye surgery, such as laser treatments like LASIK and cataract surgery, can be puzzling. Generally, Original Medicare, which comprises Part A (hospital insurance) and Part B (medical insurance), doesn't cover LASIK or any laser surgery primarily aimed at correcting vision only. This is because these procedures are often categorized as elective surgeries. However, when it comes to cataract surgery, there is a silver lining. Medicare Part B will cover medically necessary procedures, including cataract surgery, especially when they involve intraocular lenses to replace cataracts. This coverage extends to basic post-surgery eyeglasses or contact lenses, offering some relief to patients. Yet, Medicare doesn't usually cover more advanced lasers or multifocal lenses without an explicit medical reason. Medicare Advantage plans can potentially fill in gaps by offering additional vision care benefits. These plans, offered by private companies approved by Medicare, often include services Original Medicare doesn't cover, but they come with their own rules and might still exclude LASIK. For those seeking laser eye surgery for vision correction, reviewing alternative health care options might be necessary to understand what’s covered and if any out-of-pocket costs can be minimized through supplementary insurance plans, ensuring better financial preparation.Alternative Coverage Options

Exploring Additional Insurance Options

While Original Medicare may not cover elective procedures like LASIK eye surgery, there are other avenues to consider for financial assistance. If you are looking into laser eye surgery, understanding your insurance options is crucial.

- Medicare Advantage Plans: Some Medicare Advantage plans might offer additional vision benefits that Original Medicare does not. These plans, offered by private insurance companies, may include coverage for routine eye exams, glasses, and sometimes even discounts on LASIK surgery.

- Private Health Insurance: Depending on your private health insurance plan, there might be partial coverage or discounts available for laser eye surgery. It's essential to review your policy details or contact your insurer to understand what is covered.

- Vision Insurance Plans: Separate vision insurance plans often provide benefits for eye exams, glasses, and contact lenses. Some may also offer discounts on laser eye procedures, so exploring these options could help reduce out-of-pocket costs.

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): These accounts allow you to use pre-tax dollars to pay for eligible medical expenses, including LASIK surgery. This can be a tax-efficient way to manage the costs associated with laser eye procedures.

In addition to these insurance options, some eye care providers offer financing plans or payment plans to make the cost of LASIK surgery more manageable. It’s worth discussing these possibilities with your provider to find a solution that fits your budget.

Financial Considerations for Patients

Evaluating Financial Impacts for Eye Procedures

When considering procedures like laser eye surgery, understanding the financial commitment becomes crucial especially if you're relying on insurance plans. For many, the decision often hinges on what costs are out-of-pocket versus what insurance will manage. Here are some financial considerations for those looking into these eye surgeries:- Out-of-Pocket Expenditures: While Original Medicare provides coverage for certain services like cataract surgery, it typically doesn’t cover LASIK or other laser eye surgeries aimed at correcting vision issues. Consequently, patients should be prepared to shoulder these expenses independently.

- Exploring Medicare Advantage: Some Medicare Advantage plans offer additional vision benefits beyond what Original Medicare covers. Checking if such a plan includes coverage for LASIK can be beneficial. Remember, the specifics vary significantly between different Advantage plans.

- Insurance Plan Differentials: Not all insurance plans are created equal, and coverage for lasik surgery can vary. Some private health insurance options might include full or partial coverage for certain eye surgeries, based on the plan specifics.

- Potential Long-term Savings: Investing in surgery like LASIK may seem expensive upfront, but it could potentially save costs in the long run by reducing the need for glasses, contact lenses, and regular prescription changes.

- Financing and Payment Options: For procedures not covered by insurance, many providers offer financing plans. This can help spread the cost over time, making the procedure more financially accessible for patients.